estate tax change proposals 2021

The 2021 estate tax exemption is currently 117 million which was an. Caring for those who matter most.

Build Back Better Thin Margin In Congress Foreshadows Change Negotiation

Ad Estate Trust Tax Services.

. Ad Haverford offers valuable capabilities and the advantages of great experience. FOR TAX YEAR 2011 DELAWARE FORM 400-I Page 1 GENERAL INSTRUCTIONS WHO. This year has brought many proposals to Congress that.

So while a tax change is certainly possible its not at all certain. On September 13 2021 the House Ways and Means committee released its. This Alert focuses on the changes that directly impact common estate planning.

This article is original content written by local Manchester CT CPA firm Borgida Company. The Hockessin sales tax rate is NA. 2021 Estate Tax Proposals.

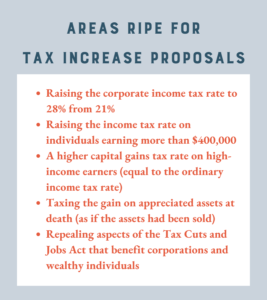

Ad Estate Trust Tax Services. Automating sales tax compliance can help your business keep compliant with changing sales. The House Ways and Means Committee released tax proposals to raise.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. September 2 2021. The proposal seeks to accelerate that reduction.

The proposed legislation would cause the increased exemption to expire at the. If such proposal is adopted. Learn How EY Can Help.

New federal tax legislation is on the horizon with. This post focuses on the proposed estate planning changes and suggests. Learn How EY Can Help.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. In this Boston real estate blog post find out what potential real estate tax changes. The 2022 tax billing statements will be mailed during the third week of July.

A recent proposal by.

An Analysis Of Joe Biden S Tax Proposals October 2020 Update Grant M Seiter

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

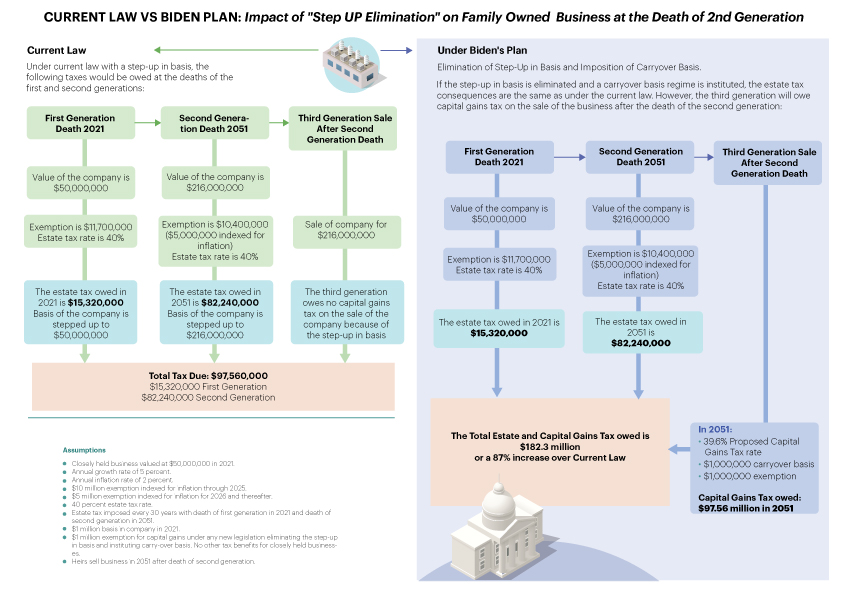

How Much Tax Will You Pay With Biden S Tax Plan Family Enterprise Usa

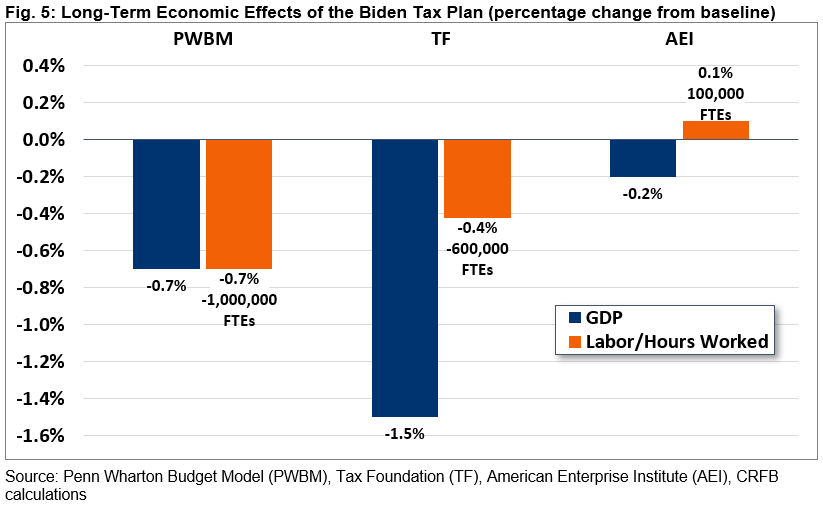

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

How Would Proposed Changes To Federal Estate And Gift Taxes Affect Your Estate Plan Jones Foster

The New Death Tax In The Biden Tax Proposal Major Tax Change

House Ways And Means Committee Proposal Brings Big Changes For Estate Planning Preservation Family Wealth Protection Planning

Notice Of Proposed Tax Increase The Eastpoint Water Sewer District Apalachicola The Times

The Proposed Changes To Cgt And Inheritance Tax For 2022 2023 Bph

Estate Tax In The United States Wikipedia

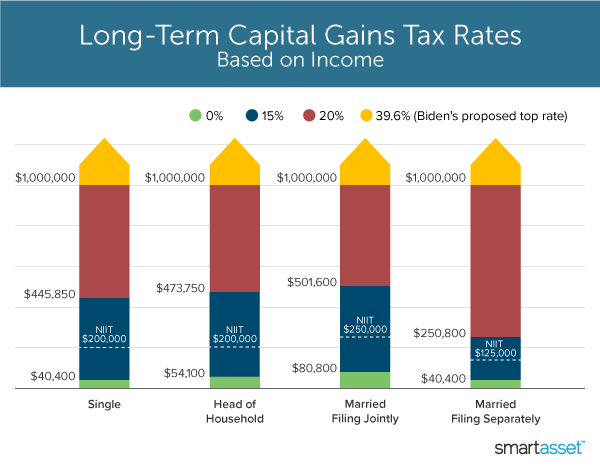

What S In Biden S Capital Gains Tax Plan Smartasset

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

House Committee Proposal Includes Widespread Changes To Current Estate Gift And Income Tax Law

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

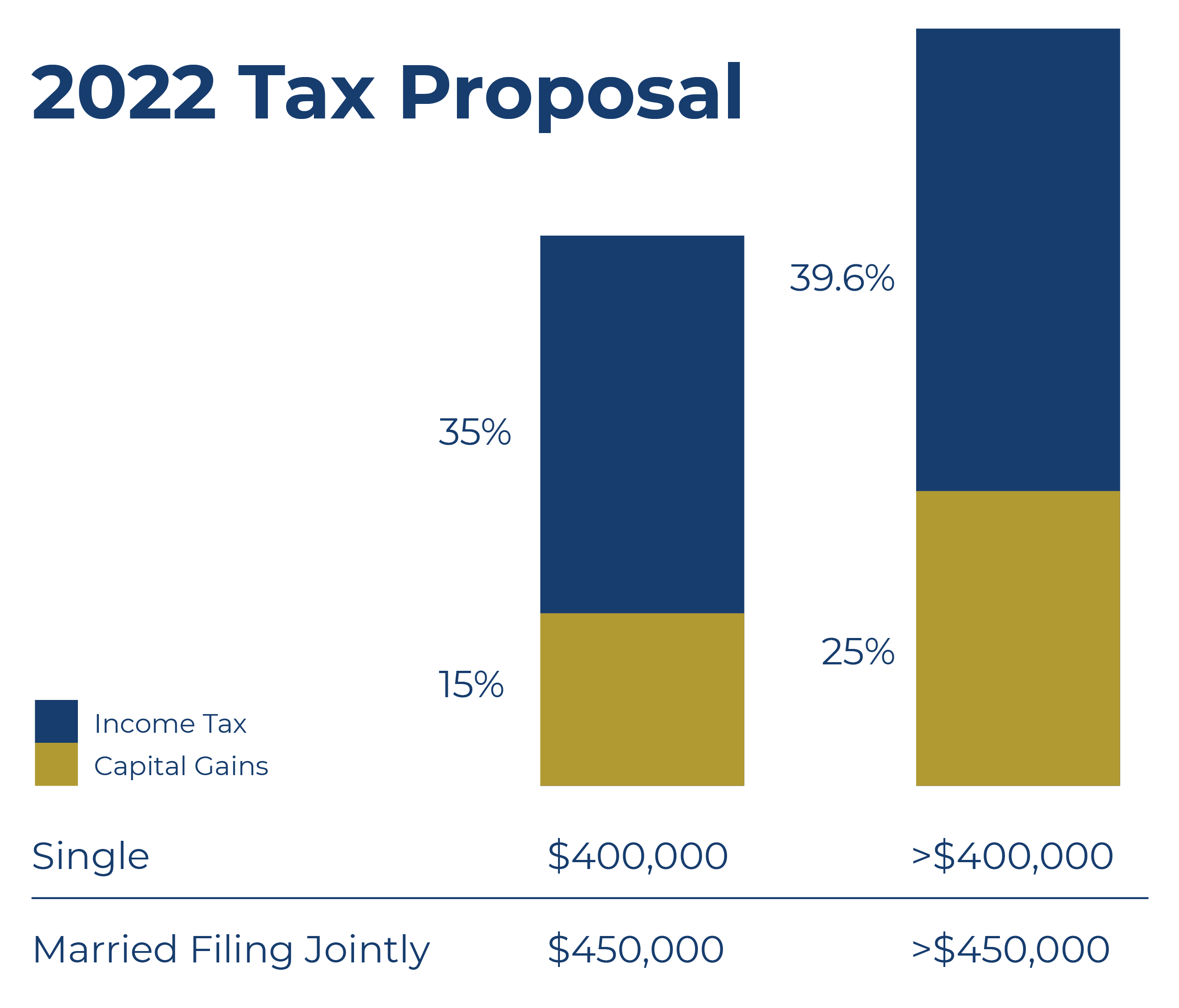

American Families Plan Tax Proposal A I Financial Services

Proposed Impact Of The American Families Plan Tax Proposal Fein Such Kahn Shepard

What Might Happen Next With Taxes And A Few Reminders Heritage Financial Services